No interest, no upfront cost, and no fees as long as you repay on time—sounds good, doesn’t it?

That’s why in Jun 2019, I signed up for my first ‘buy now, pay later’ (BNPL) service Grab PayLater. My application was approved quickly.

I also know of friends who use Atome, Hoola, Rely and other similar BNPL services for their spending needs.

According to a 2020 report by financial products comparison platform Finder, which surveyed more than 1,000 Singaporeans aged 16 and above, 40 per cent of 16 to 24-year-olds have used a BNPL service. Similarly, more than 43 per cent of those between 25 and 44 years old have used BNPL, while a lower proportion of those above 45 have done so.

When contacted, a Grab spokesperson said that the company noticed “an increase in the number of young people using PayLater by Grab.”

She added: “The service is definitely suitable for users who are looking for greater flexibility and options to pay for their purchases”.

And that’s exactly what I was looking for.

At first, I used Grab PayLater solely for transport expenses, but throughout the pandemic, I relied on it more for other purchases, including food deliveries. After a few months, I noticed that my credit limit went up from $500 to $3,000 even though I didn’t request for the increase.

I assumed this happened due to my financial habits—after all, I diligently made sure to pay my debts on time. Grab’s spokesperson confirmed this, explaining that an increased limit “is determined by the user’s track record, which includes usage, overall spending, and payment history”.

However, I can see how this can lead to overspending. Even though I monitored my expenses carefully, I recall that my initial monthly budget of $250 increased to $800 after I received a higher spending limit, so it’s easy to fall into the temptation of spending more.

Ms Rachel Kang, a 22-year-old student from Ngee Ann Polytechnic, uses the PayLater service mainly for “convenience” because she can easily consolidate and keep track of her spending at a glance. She also sees the benefit of earning rebates through Grab points.

But she agrees that she, too, may fall into the trap of overspending with a higher spending limit.

Remarkably, one cannot request for a lower spending cap. It may only decrease automatically according to the company’s criteria.

“You just have to use it to your advantage…but never abuse it,” says Ms Kang. She adds that it is essential to “keep track of your spendings” when using BNPL services.

Mr Wayne Oh, a Singapore Institute of Management (SIM) student, agrees. “It is relatively convenient but one might overspend if there’s no discipline … Whoever decides to use services like PayLater should be responsible for their own spending.”

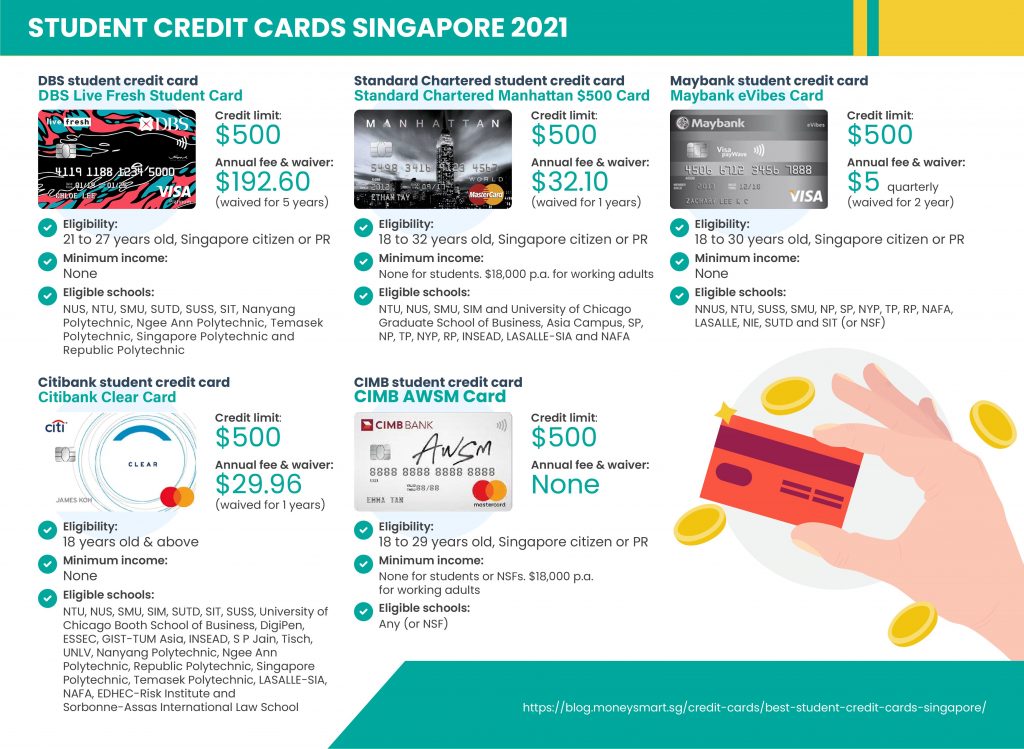

But, there are those who believe that BNPL services remain a better alternative to student credit cards. Personally, I never saw a need to apply for credit cards, considering that BNPL services are more convenient.

Ms Dawn Cher, also known as SG Budget Babe, one of Singapore’s most popular financial bloggers, adds that student credit cards come with high fees and interest rates. On the other hand, she explains that BNPL services don’t charge interest “and even in the event of a late payment, your penalty charges are relatively low compared to what you’ll be paying on a credit card.”

For Grab PayLater, the spokesperson highlighted that in the case of a missed payment, the account “will be suspended to prevent a debt spiral”. It can be reactivated after users make the interest-free payment plus a one-time $10 reactivation fee.

In this regard, Ms Cher highlights the merits of BNPL for students. She shares that “it is better for a student with no fixed income to start with Grab PayLater services and learn how to pay off the fees on time”, as the late payment fees of a credit card are significantly higher.

Proofread By: Rytasha Passion Raj