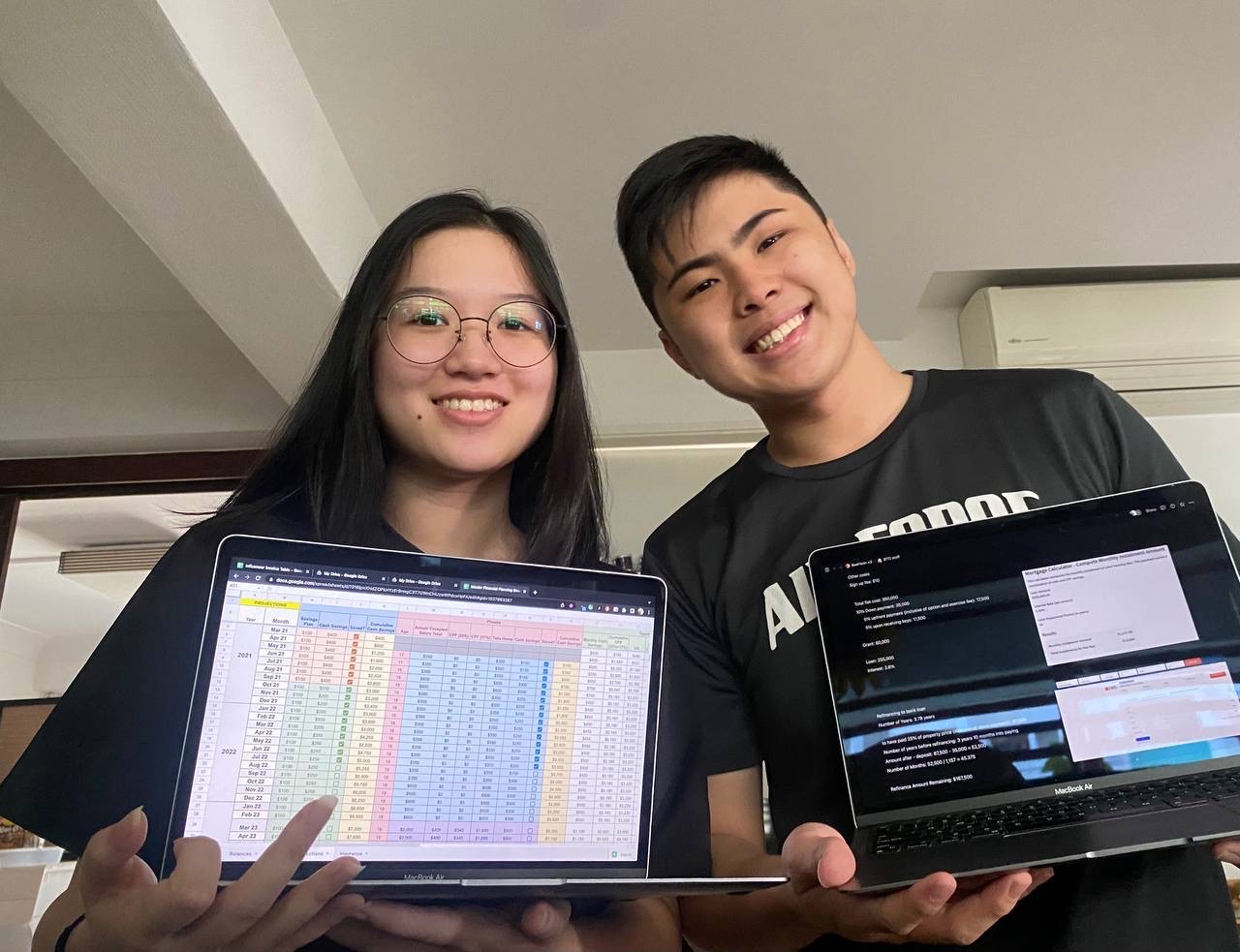

Photo Credit: Phoebe Yen

Just six months into their relationship, Phoebe Yen, 19, and Ryan Lim, 21, started talking about applying for BTO flats.

“We just thought that it’s another thing that you should talk to your other half about,” Mr Lim said. “We like to project-manage our life, so planning was a natural next step.”

BTO flats are Housing Development Board (HDB) flats that will commence construction only when 65 to 70 per cent of the units have been booked by applicants. The construction will take three to five years before homeowners can get the keys to their new homes.

With the encouragement and support of their parents, the couple started their research.

“We started reading articles and watching videos on how to apply for a BTO and what are the grants available,” Ms Yen said.

They created an Excel sheet to keep track of their financial assets, projected income and individual contributions towards their targeted combined savings for their future BTO flat.

Before being a National Serviceman (NSF), Mr Lim was working as a marketing manager, so he’s started contributing to their savings. Ms Yen also contributed some of her income from part-time and freelance jobs.

“We calculated our CPF, our investments and our cash-on-hand amount,” Ms Yen added.

They also send records of their daily and monthly individual expenses to keep each other informed so that they won’t overspend unnecessarily.

The two are confident that they will be able to save up enough to apply for a three or four-room flat in three years’ time.

They hope they will get a good ballot number, but in any case, they are prepared to wait.

“For the four years we are waiting [for the BTO], we can stay unmarried because marriage is another expensive factor to consider,” Ms Yen said.

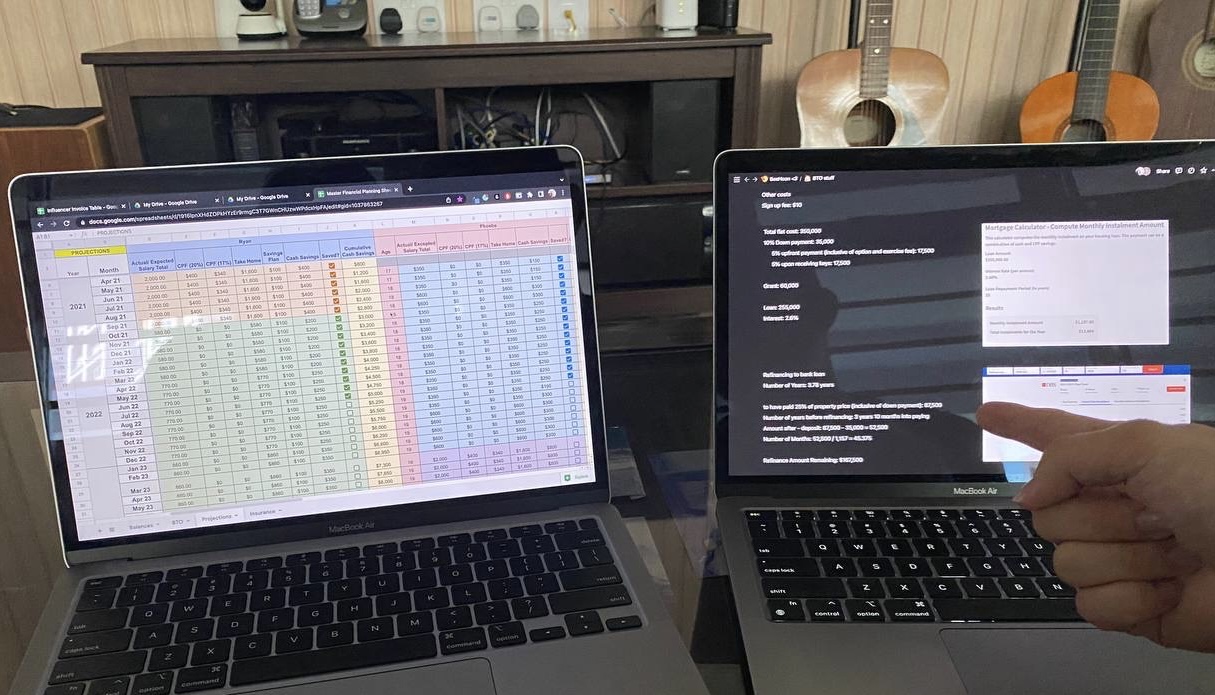

Photo Credit: Ryan Lim

Their biggest concern is the possibility of breaking up after a successful application. “I’ve heard a lot of horror stories where people break up after paying for their deposit,” Ms Yen said. “And they lose all their deposit,” Mr Lim added.

To ensure this doesn’t happen to them, they added a special cell in their Excel spreadsheet to remind them to consider the stability of their relationship before committing to the purchase.

“BTO is a very big commitment for any couple, we want to make sure that we’re clear with what we’re doing,” Ms Yen said.

Photo Courtesy of Stella Tay.

Unlike Ms Yen and Mr Lim who chose to save up first, another young couple started applying for a BTO flat when one of them was still a full-time polytechnic student while the other just graduated from the same school.

Ms Stella Tay, 24, and Mr Woo Guo Wen, 26, expected to go through at least five unsuccessful applications when they tried their luck in November 2020, but to their surprise, they got a flat at their first try.

After receiving almost $65,000 from HDB’s Enhanced CPF Housing Grant (EHG), they were able to pay for the deposit.

Although things were moving faster than they expected, they thought they had made the right choice. “Our decision back then was right because applying for a BTO doesn’t mean that we’ll get it immediately, we have to wait for four to five years,” Ms Tay said.

It helped that the couple had lived together in Ms Tay’s family home during the height of Covid-19 in 2020. “We experienced what it is like staying with each other, similar to married couples,” Ms Tay said. “Some of our habits, we didn’t know until we lived with each other.”

This experience gave them the confidence that they could live with each other for the rest of their lives.

They couple have since tied the knot on 6 Jun 2022, and are now living in a rented apartment while waiting for their BTO flat to be built.

The completion date was supposed to be in April 2024, but it’s been delayed to December 2024.

“The longer it delays, the longer we’ll have to rent the place we’re living in now,” Mr Woo said.

Renting in Singapore wasn’t an easy decision to make since the couple have only started working after their graduation in 2020 and 2022 respectively. They had to be very cautious of how they spend and manage their money.

Ms Tay shared: “I see my colleagues and friends spending more and living a better life than me but this is the sacrifice that we chose to make so that we can enjoy life later.”

While they could have lived with their parents, they prefer to have more privacy and autonomy. “Since we are both brought up very differently, we want to live together without a third-party influence,” said Mr Woo.

Ms Tay also agrees that moving out has more pros than cons. “Once we move out, there will be no more protection from our parents,” she said. “We can only rely on each other, so from there we can grow together as a couple.”

Proofread By: Darrius Chua and Shannon Gan